Financials

Full Year Financial Statement And Dividend Announcement 2025

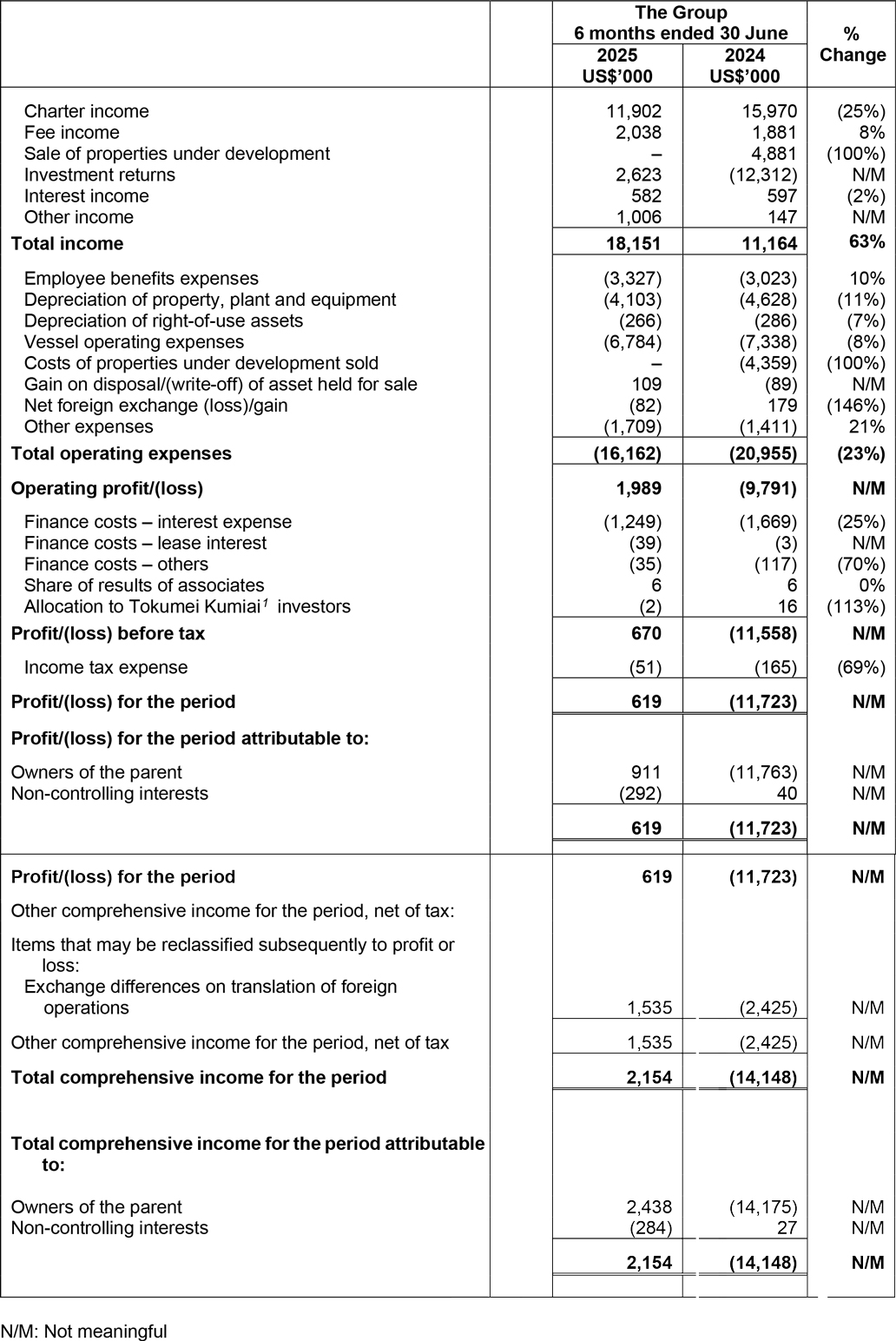

Financials ArchiveCONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE SIX MONTHS ENDED 30 JUNE 2025

1Tokumei Kumiai (“TK”) refers to a form of silent partnership structure used in Japan. Allocation to TK investors refers to share of profit and loss attributable to other TK investors of the TK structure.

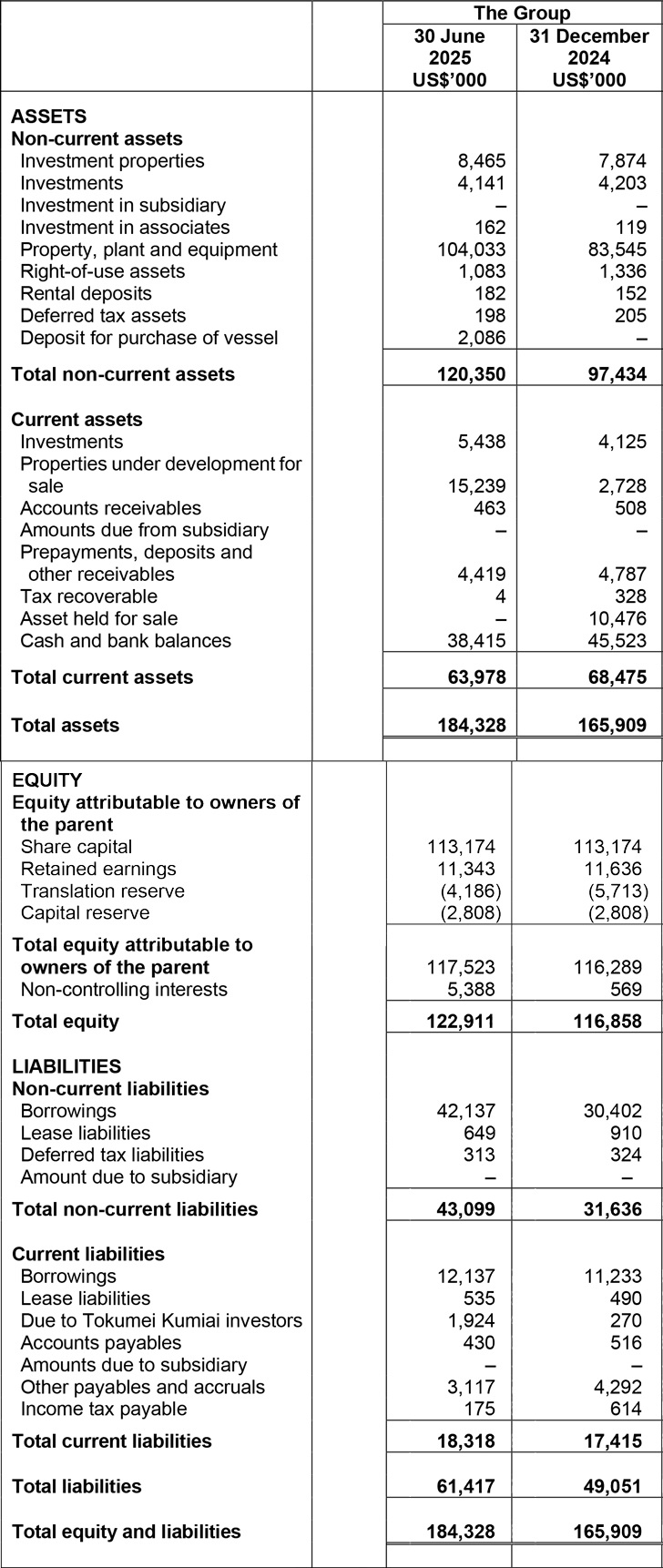

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITIONS AS AT 30 JUNE 2025

Review of Performance

REVIEW OF CONSOLIDATED STATEMENT OF PROFIT OR LOSS

Total Income

The Group's total income for the six months ended 30 June 2025 (“1H2025”) was US$18.2 million, a 63% increase from US$11.2 million in the corresponding period of 2024 (“1H2024”). Changes in major components of total income are set out below:

(i) Charter Income

Charter income decreased 25% to US$11.9 million in 1H2025 (1H2024: US$16.0 million).

- Fleet profile: In 1H2024, the Group operated five 38k DWT and four 29k DWT wholly-owned ships before disposing of one 29k DWT vessel in February 2024. At the start of 1H2025, the Group operated five 38k DWT and two 29k DWT wholly-owned ships before disposing of one 29k DWT vessel in January 2025, while acquiring a 75% stake in 58k DWT M/V Kellett Island on 25 February 2025.

-

Charter hire days: Maximum possible charter days were 1,521 in 1H2024 (actual: 1,493 days; 2% offhire). In 1H2025, possible charter days were 1,243 but actual operating days were 1,093 with 12% offhire due to:

- M/V Glengyle’s scheduled drydocking and subsequent collision on 25 April 2025 (off-hire since then).

- Other scheduled drydockings and ad hoc repairs for other ships within the fleet.

- Charter rates: Average daily charter rate improved slightly to US$10,840/day (1H2024: US$10,699/day). However, reduced operating days led to lower overall charter income.

(ii) Fee Income

Fee income increased 8% to US$2.0 million (1H2024: US$1.9 million).

- Asset management and administration fees fell to US$1.2 million (1H2024: US$1.3 million) with the Group’s gradual wind down of Wealth Ocean Ship Management Shanghai Co., Ltd (“WOSMS”) (see presentation slide page 37 for more information) resulting in decrease in ship management fee income.

- Arrangement and agency fees rose due to property deals in Japan.

- Brokerage commissions increased on the back of a one-off ship brokerage deal.

(iii) Sale of properties under development

No projects were sold in 1H2025 as all ongoing properties under developments were still under construction.

(iv) Investment Returns

Investment returns recorded a net gain of US$2.6 million, reversing a US$12.3 million loss in 1H2024.

- This included US$2.2 million valuation gains from 18% ship joint investments which the Group is exiting in 2H2025.

- Property rental income remained steady at US$0.3 million (1H2024: US$0.3 million).

(v) Interest Income

Stable at US$0.6 million (1H2024: US$0.6 million).

(vi) Other Income

Other income was US$1.0 million, mainly from insurance recoveries relating to ship incidents and government grants in Singapore.

Total Operating Expenses

Operating expenses decreased 23% to US$16.2 million (1H2024: US$21.0 million), with the following drivers:

- Employee benefits rose 10% to US$3.3 million due to promotions and new hires for succession planning and expansion, as well as exit compensation for WOSMS staff in accordance with China’s regulatory requirements.

- Depreciation fell 11% to US$4.1 million (1H2024: US$4.6 million) following vessel disposals.

- Vessel operating expenses fell 8% to US$6.8 million (1H2024: US$7.3 million) with a smaller fleet.

- No costs of properties under development sold was recorded in 1H2025 as all ongoing properties under developments projects were still under construction.

- Other expenses rose 21% to US$1.7 million, mainly from higher deal-related professional fees in Japan.

Operating Profit

The Group achieved an operating profit of US$2.0 million in 1H2025, compared to an operating loss of US$9.8 million in 1H2024.

Finance Costs and Other Costs

Finance costs declined 25% to US$1.2 million, reflecting loan repayments from ship disposals and scheduled repayment.

Net Profit After Tax

The Group posted a net profit after tax of US$0.6 million, a turnaround from a loss of US$11.7 million in 1H2024.

Review of Statement of Financial Positions

Non-current assets

Increased 24% to US$120.4 million (31 Dec 2024: US$97.4 million), mainly due to:

- Investment properties rose by US$0.6 million from strengthening JPY.

- Property, plant and equipment rose by US$20.5 million, reflecting acquisition of M/V Kellett Island net of depreciation.

- Deposit of US$2.1 million for purchase of M/V Uni Sunshine.

Current assets

Decreased to US$64.0 million (31 Dec 2024: US$68.5 million). Key movements:

- Short-term investments increased US$1.3 million from ship investment reclassification (from long to short term) and valuation gains.

- Properties under development for sale rose to US$15.2 million (31 Dec 2024: US$2.7 million) due to new projects and add-on capital injections to existing investments.

- Asset held for sale decreased US$10.5 million after the disposal of a vessel.

- Cash and bank balances decreased US$7.1 million.

Total liabilities

Increased to US$61.4 million (31 Dec 2024: US$49.1 million), mainly due to:

- Borrowings up US$12.6 million for ship and property acquisitions.

- Amounts due to Tokumei Kumiai investors (external minority-shareholders in Japan properties) up US$1.7 million with property development funding.

- Other payables and accruals decreased US$1.2 million with settlement of such payables and accruals.

Review of Statement of Cash Flows

The Group’s cash and bank balances decreased by US$7.1 million in 1H2025 after the effects of foreign exchange rate changes. Material items are listed below.

- Operating activities: Net outflow of US$3.0 million (1H2024: net inflow of US$6.2 million) due to lower charter income and no property under development disposals.

- Investing activities: Net outflow of US$13.9 million, mainly due to purchase of M/V Kellett Island and capitalised drydock expenses (US$24.1 million), deposits for M/V Uni Sunshine (US$2.1 million), and Japan property investments (US$2.6 million), partly offset by asset disposal proceeds (US$10.3 million) and investment distributions (US$1.5 million).

- Financing activities: Net inflow of US$9.1 million includes net borrowings of US$7.1 million and US$5.0 million from non-controlling interests, offset by interest payment of US$1.5 million and FY2024 dividends of US$1.2 million paid.

Commentary

Dry Bulk

The global dry bulk shipping market continues to face mixed dynamics. Charter rates in the Handysize and Supramax segments have remained relatively firm in 3Q2025, supported by strong demand for agricultural commodities from Southeast America to Asia in addition to stable coal and minor bulk trades. However, volatility persists due to geopolitical tensions affecting trade flows, as well as supply chain disruptions from port congestion in Southeast Asia.

On the supply side, net fleet growth remains modest, with limited newbuilding deliveries due to constrained shipyard capacity and higher construction costs. At the same time, environmental regulations under IMO’s Carbon Intensity Indicator (“CII”), Energy Efficiency Existing Ship Index (“EEXI”) frameworks, European Union’s EU-ETS, as well as FuelEU Maritime regulations are pressuring owners to invest in fleet upgrades and slow steaming, effectively tightening effective vessel supply.

For Uni-Asia, the disposal of older 29k DWT vessels and the acquisition of the larger M/V Kellett Island reflect an ongoing fleet renewal strategy to maintain competitiveness. Nonetheless, elevated off-hire days in 1H2025 highlight operational risks from drydockings and unexpected incidents such as M/V Glengyle’s collision. Insurance recoveries will partially offset losses, but in the next 12 months, operational efficiency and minimising off-hire will remain critical to profitability.

Looking ahead, while charter rates are expected to remain broadly resilient into FY2026, volatility cannot be ruled out given global economic uncertainties, energy market transitions, and potential shifts in commodity trade flows.

Japan Property

The Japanese property market continues to demonstrate resilience, underpinned by sustained demand for residential and compact urban properties in major metropolitan areas such as Tokyo, Osaka, and Fukuoka. Although the Bank of Japan (“BOJ”) has signalled gradual steps away from its ultra-loose monetary policy, interest rates remain relatively low by international standards, supporting property investment demand.

In 2025, a key trend has been growing foreign investor participation, drawn by Japan’s stable legal framework and favourable currency environment, especially following yen depreciation in earlier years. The strengthening of the JPY in 1H2025 increased the USD value of the Group’s Japan property portfolio, highlighting both opportunity and FX exposure.

Competitive conditions in Tokyo’s property segment remain intense, with rising construction costs and tighter labour markets placing pressure on developers’ margins. However, urbanisation trends and demographic shifts—particularly demand from younger professionals and smaller households—continue to provide a supportive demand backdrop.

For Uni-Asia, pipeline projects under development are expected to complete progressively in coming reporting periods. The Group’s co-investment model continues to provide capital flexibility, though higher funding requirements and competition for land acquisition may impact margins.

Hong Kong Property

The Hong Kong property market continues to face challenging conditions. The consortiums through which the Group participates in property investments remain under financial strain. Given that circumstances have not improved, the Group continues to assess the fair value of its investments in these consortiums as nil.