Financials

Half-Yearly Financial Statement And Dividend Announcement 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

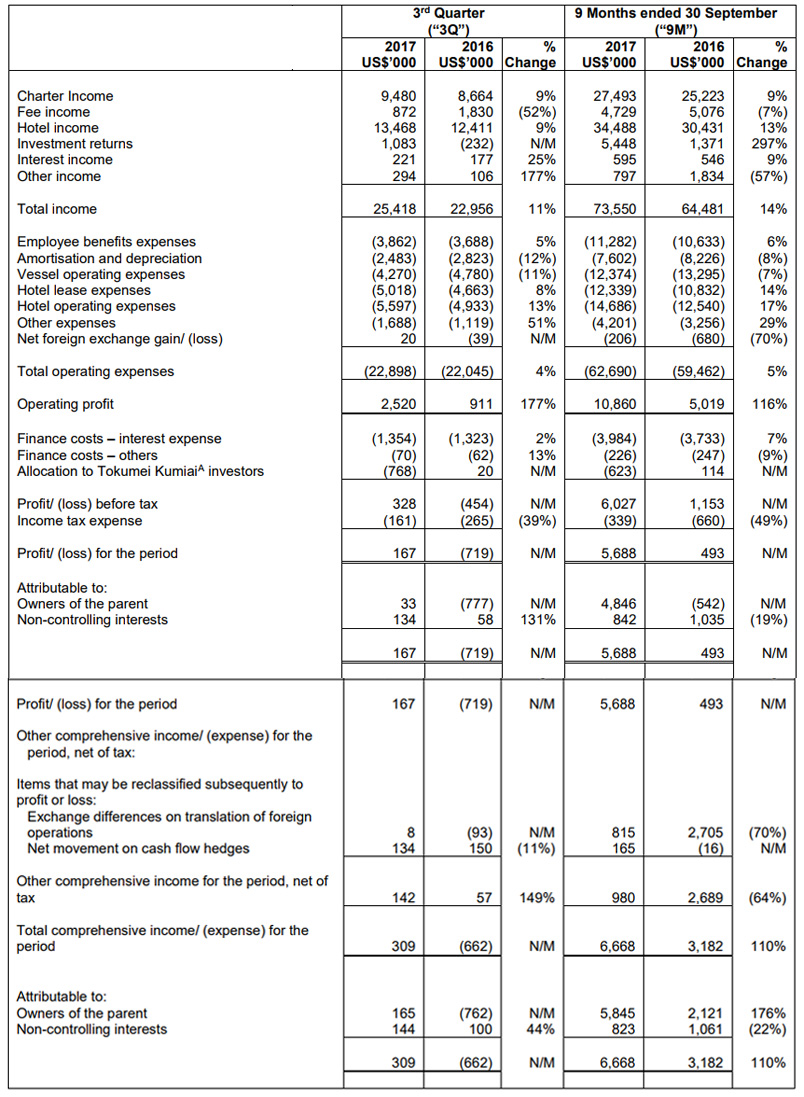

Income Statement

* Tokumei Kumiai ("TK") refers to a form of silent partnership structure used in Japan. Allocation to TK investors refers to share of profit and loss attributable to other TK investors of the TK structure.

N/M: Not meaningful

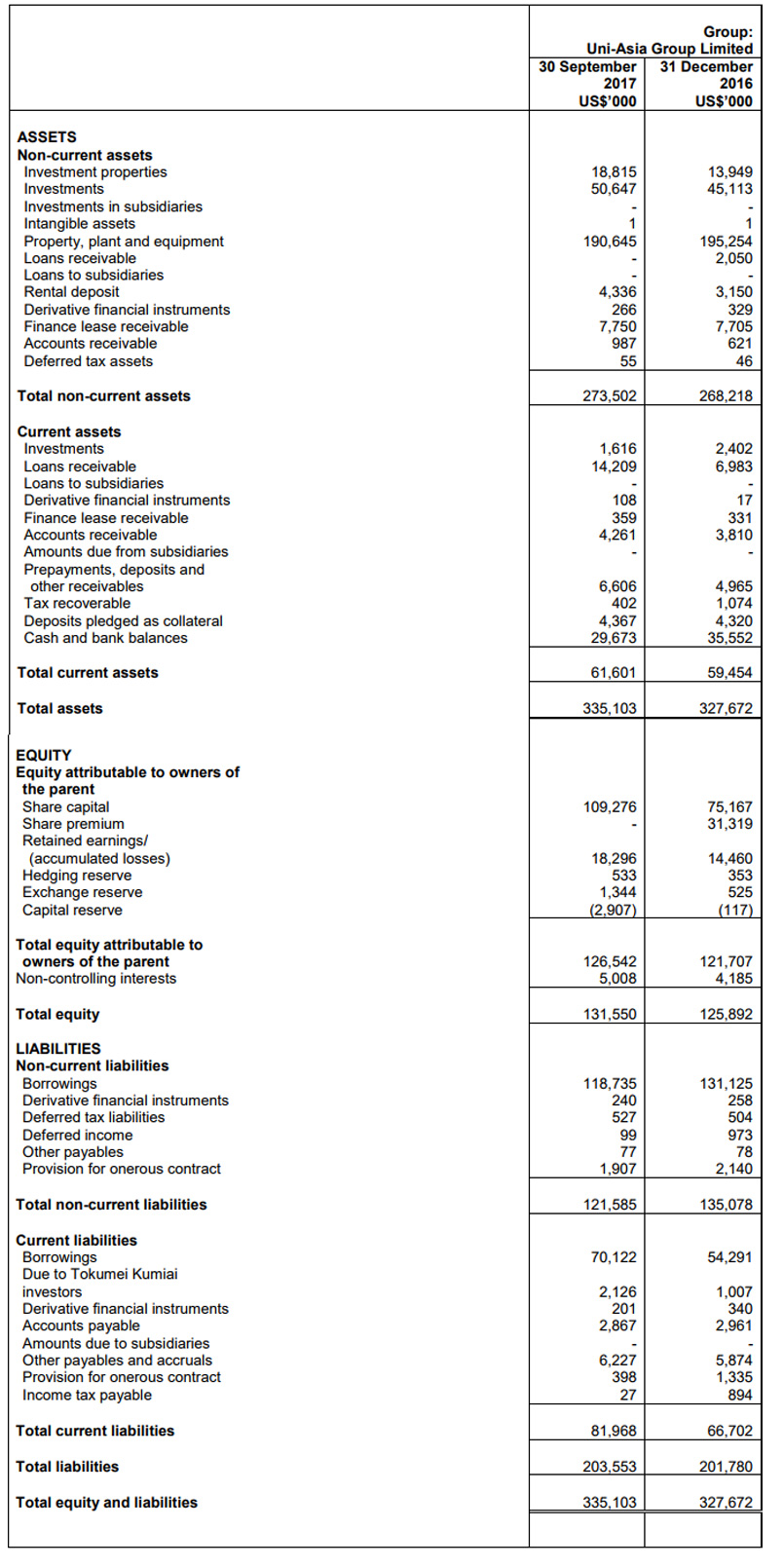

Balance Sheet

Review of Performance

Review of Income Statement

Total Income

Total income of the Group was $73.6 million for 9M2017, a 14% increase from 9M2016. Changes in major components of total income, including charter income, fee income, hotel income and investment returns are explained below.

(i) Charter Income

Charter income increased by 9% from $25.2 million in 9M2016 to $27.5 million in 9M2017. Besides better spot charter rates for the Group’s portfolio of ships under short term charter, one main factor is the inclusion of charter income of the vessel under Joule Asset Management (Pte.) Limited (“Joule”) in 9M2017, but only from 2Q2016 for 9M2016. This is because Joule became a subsidiary of the Group on 31 March 2016 and its charter income was consolidated from 2Q2016 for 9M2016.

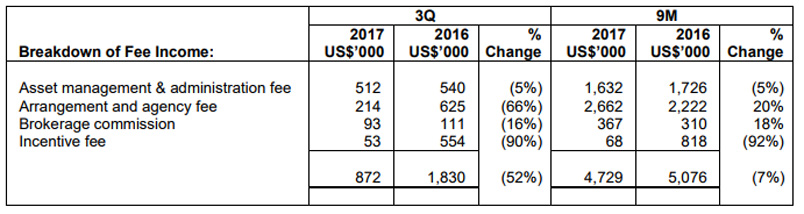

(ii) Fee Income

Total fee income decreased by 7% to $4.7 million in 9M2017 from $5.1 million in 9M2016. Fewer deals for 3Q2017 resulted in lower arrangement and agency fee income. Fewer disposal of assets under management resulted in lower incentive fee for 3Q2017.

(iii) Hotel Income

The Group started operating 232-room Hotel Vista Premio Yokohama Minato-Mirai from 30 June 2017 and 143-room Hotel Vista Nagoya Nishiki from 1 September 2017. On the other hand, the hotel operating contract for 141-room Hotel Vista Premio Dojima in Osaka ended on 31 July 2017. Average occupancy rates of the hotels were slightly lower in 9M2017 compared to 9M2016 but average daily rates remained strong. Hotel Income increased by 13% from $30.4 million in 9M2016 to $34.5 million in 9M2017.

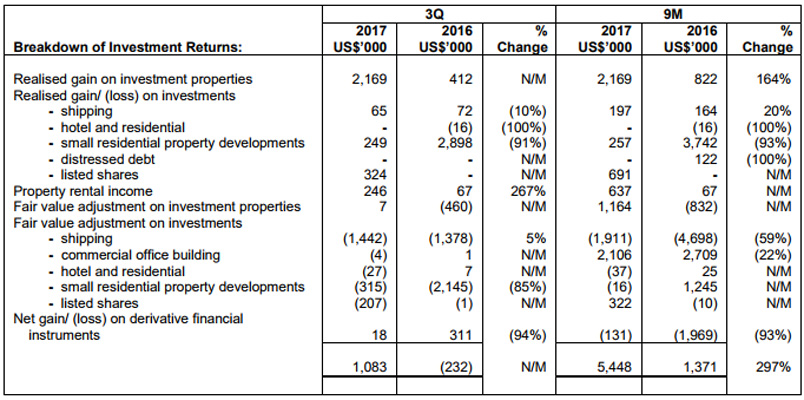

(iv) Investment Returns

n 3Q2017, realised gain on investment property of $2.2 million for a small residential property project helped to offset additional net fair valuation loss of $1.4 million booked mainly for tanker and containership investments. Investment returns for 3Q2017 was $1.1 million compared to negative investment returns of $0.2 million in 3Q2016.

Investment returns for 9M2017 was $5.4 million compared to $1.4 million in 9M2016.

Total Operating Expenses

While the Group’s total income increased by 14%, the Group’s total operating expenses increased by a lower rate of 5% from $59.5 million in 9M2016 to $62.7 million in 9M2017. Employee benefits expenses, hotel lease expenses and hotel operating expenses increased in line with the increase in the number of hotels under operations.

Impairment booked in FY2016 resulted in lower depreciation expense for 9M2017, while onerous contract provisions taken by the Group in FY2016 lowered vessel operating expenses for 9M2017.

Operating Profit

Operating profit of the Group was $10.9 million for 9M2017, an increase of 116% compared to $5.0 million for 9M2016. Operating profit for 3Q2017 was $2.5 million compared to $0.9 million for 3Q2016.

Net Profit After Tax

The Group posted a net profit after tax of $5.7 million for 9M2017, as compared to $0.5 million for 9M2016. Net profit after tax of $0.2 million in 3Q2017 compared favourably to a loss of $0.7 million in 3Q2016.

Commentary

The Baltic Dry Index was 961 as at end of 2016 and reached 1,356 as at end of September 2017, an indication that the dry bulk market is improving. Although 2017’s market charter rates are better than one year ago, there is still much room for improvement. According to Clarksons Report, 2017’s handysize bulkers’ deliveries is expected to be around 5.4 million dwt, while the orderbooks for handysize bulkers for 2018 and 2019 are 2.6 million dwt and 1.0 million dwt respectively. If the demand in dry bulk market maintains or improves, while other economic factors remain positive, the dry bulk market could see better days ahead. On the other hand, the outlook for tanker and containership market is not as good as the dry bulk market. Should the containership’s charter/resale market rates stay below historical average level, the Group may need to take further downward fair valuation adjustments for the containership investments in the Group’s portfolio.

Meanwhile, the property and hotel markets in which the Group operates remain robust. The Group’s second Hong Kong commercial office property investment’s construction is on schedule. The Group expects to exit and receive proceeds from this investment by mid-2018.